Volume XXII, No. 12 (No. 577)

Friday, November 27, 2020

A Biweekly Electronic Newsletter

As a public service, Hurwitz & Fine, P.C. is pleased to present its biweekly newsletter, providing summaries of and access to the latest insurance law decisions from the New York and Connecticut appellate courts and Canadian appellate courts. The primary purpose of this newsletter is to provide timely educational information and commentary for our clients and subscribers.

In some jurisdictions, newsletters such as this may be considered Attorney Advertising.

If you know of others who may wish to subscribe to this free publication, or if you wish to discontinue your subscription, please advise Dan D. Kohane at [email protected] or call 716-849-8900.

You will find back issues of Coverage Pointers on the firm website listed above.

Dear Coverage Pointers Subscribers:

Do you have a situation? We love situations.

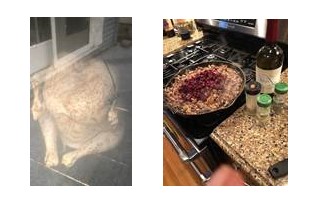

We’re sending this one a few hours earlier, than usual. Traditionally, we send out our alternate Friday issues, sometime after 6:00 PM Eastern, on Thursday, so that our cover note and attached issue, greet you on Friday morning. But the gobblers call, and we have one in the oven and one in the smoker, and we thought we’d drop this issue in the mail before. Here’s the turkey in the smoker and the mid-point of preparation of my three-mushroom, sausage, craisin and candied walnut, bread stuffing for the over offering:

Later this afternoon, we will be delivering turkey dinners, with all the trimmings, to family and friends, those who cannot otherwise share a common space with others. We wish you and yours a happy and healthy Thanksgiving. We hope you have found a way to celebrate that made sense to you and your family, kept everyone healthy and are ready for the continuation of the holiday season. We all need some semblance of normalcy.

This week’s offerings:

This week’s issue, attached, has several very interesting decisions worth your close perusal. The high court, the Court of Appeals, deals with the very interesting question of whether an excess carrier is responsible to (a) step down and (b) make interest payments, if a primary carrier’s coverage is not available because the policy was rescinded. The First Department issues a decision which clearly and unequivocally allows a liability insurer to reserve its right to recoup defense costs from its insured if it ultimately determined that there is no obligation to indemnify it. And that same court struggles with the obligations of a CGL and Auto carrier’s obligation to defend a mutual insured when someone unloading a truck trips on a sidewalk defect.

All good reading for the long weekend.

Risk Transfer Training:

So much of my casualty coverage work, these days, focuses on risk transfer – additional insured questions, contractual hold-harmless agreements and how the interrelationship between them impacts on the ultimate resolution of complex cases. We are conducting, via Microsoft Teams, a regional training program on risk transfer next week for a good client. If your shop can benefit from that training, let me know and we can arrange a date and time to help train your staff.

We have now scheduled or are in the process of finalizing the scheduling of five private sessions of this program, each one specially modified and crafted to meet the particular needs of the companies who have asked for the training. If interested, let me know.

New York Coverage Protocol Training:

Another very popular program is one designed to remind, refresh or instruct claims professionals who handle New York insureds, claims and policies, on the special nuances (and traps) that are part of the New York coverage experience. Does your staff need it? Here’s the way to find out. Ask your staff these questions:

- Are you sending out reservation of rights letter in NY claims?

- Do you know the “30-day” rule?

- Are you certain you know who gets copies of coverage position letters in New York?

- If the insured fails to respond to 10 letters seeking cooperation, can you successfully deny coverage for lack of cooperation?

- If the insured gives you notice of an accident, five years after it occurred, in violation of notice obligations in the policy, is that enough to sustain a late notice disclaimer?

If the answer to question “1” was “yes” or the answer to any of the remaining questions were “no”, sign up for NY Protocol training.

Newsletters:

We have other firm newsletters to which you can subscribe by simply letting the editor (or me) know, including a new publication, which was created to advise on business and employment law questions:

-

Employment & Business Pointers aims to provide our clients and subscribers with timely information and practical, business-oriented solutions to the latest employment and general business law developments. Contact Joseph S. Brown [email protected] to subscribe.

-

Premises Pointers: This monthly electronic newsletter covers current cases, trends and developments involving premises liability and general litigation. Our attorneys must stay abreast of new cases and trends across New York in both State and Federal Court and will now share their insight and analysis with you. This publication covers a wide range of topics including retail, restaurant and hospitality liability, slip and fall accidents, snow and ice claims, storm in progress, inadequate/negligent security, inadequate maintenance and negligent repair, service contracts, elevator and escalator accidents, swimming pool and recreational accidents, negligent supervision, assumption of risk, tavern owner and dram shop liability, homeowner liability and toxic exposures (just to name a few!). Please drop a note to Jody Briandi at [email protected] to be added to the mailing list.

-

Labor Law Pointers: Hurwitz & Fine, P.C.’s Labor Law Pointers offers a monthly review and analysis of every New York State Labor Law case decided during the month by the Court of Appeals and all four Departments. This e-mail direct newsletter is published the first Wednesday of each month on four distinct areas – New York Labor Law Sections 240(1), 241(6), 200 and indemnity/risk transfer. Contact Dave Adams at [email protected] to subscribe.

-

Products Liability Pointers: Whether the claim is based on a defective design, flawed manufacturing process, or inadequate instructions/warnings, product liability litigation is constantly evolving. Products Liability Pointers examines recent New York State and Federal cases as well as high court decisions from other jurisdictions, keeping our readers up-to-date with the latest developments and trends, and providing useful practice tips and litigation strategies. This monthly newsletter covers all areas of product liability litigation, including negligence, strict products liability, breach of warranty claims, medical device litigation, toxic and mass torts, regulatory framework and governmental agencies. Contact Brian F. Mark at [email protected] to subscribe.

- Medical & Nursing Home Liability Pointers. Hurwitz & Fine, P.C.’s newest legal alerts contain timely news on the impact of COVID-19 on medical and nursing home liability claims. Contact Chris Potenza at [email protected] to subscribe.

Peiper on Property and Potpourri:

A very Happy Thanksgiving to you. In what has been a trying year for all of us, it is comforting to celebrate and remember all the blessings we experience each day. Despite daily challenges pandemic related (or not), a moment of personal reflection helps refocus on the things that are truly good in our lives.

Now, on to business. We wanted to take a brief moment from turkey, turkey sandwiches, and the day after turkey ala king to take a bit of a deeper dive into the Second Department’s decision in Parauda v. Encompass which is reviewed in this issue’s column. The case starts with the Appellate Division reversing the trial court, and, essentially, holding the line on the definition of a “collapse” as found in the vast majority of property policies these days. For those not familiar, or those in need of a brush up, collapse is usually excluded from coverage. The coverage is then granted back, but under a coverage extension with a very limited definition of the act. To qualify as a “collapse,” the building must actually fall down or cave in. Buildings in danger of collapse will not be interpreted as, and as such are not defined as being, in a state of collapse.

What happened here was the exterior bricks of the plaintiffs’ home showed signs of stress (mortar cracking, bricks bulging from the existing frame). Upon inspection, significant damage from years of water decay and neglect was revealed to the wooden framing material. The building had not “collapsed,” however, as defined by the policy.

What should be noted from this part of the decision is a simple, but very important point. Collapse is a coverage extension which must be proven by the plaintiff. However, under most policies, coverage remains “triggered” under the general coverage grant --- unless there is an applicable exclusion. Recall, coverage is triggered where there is loss caused by risk of a direct physical loss not otherwise excluded. It is not enough to simply say the “collapse” coverage extension does not apply. In order to have complete relief awarded, the movant (i.e., carrier) must also establish that an exclusion applies to bar the claim. Unless, and until, the carrier meets that burden, there is no need to proceed with an analysis of the additional coverage for “collapse.”

We would submit, however, that the second part of the Paruada decision is the far more consequential piece. That portion deals with the issue of litigation holds for insurance companies, and whether the failure to institute a formal litigation hold results in the basis for a discovery sanction. In this case, the insured claimed that the insurer’s decision to discard internal emails and documentation about the claim constituted spoliation.

The Court’s ruling, however, noted that a litigation hold was not necessary until the date that Encompass decided to proceed with a coverage denial. There is good reason for that determination.

Recall, the Appellate Division’s standing rule in Landmark Ins. Co. v. Beau Rivage Restaurant which refused to extend the discovery exception for material prepared in anticipation of litigation for items marshaled by the insurer before it decided to disclaim. The rule is that documentation is discoverable because the evaluation of claims is part of the ordinary course of business for an insurer. Surely, a carrier would not have reason to anticipate litigation by simply investigating a claim.

With this rule already in place, it follows that with respect to a spoliation charge a carrier would likewise have no reason to institute a litigation hold during the evaluation of a claim because the duty to preserve material is guided, in part, by the discarding party appreciating the likelihood of forthcoming litigation. Absent bad faith by the carrier, it has been determined as a matter of law that a carrier cannot anticipate litigation until the decision to deny coverage. As such, applying that same logic, there can be no formal need for a litigation hold until after the decision to deny is reached.

For materials prepared after the decision to deny is reached, we note that all such materials are most likely exempt by the material prepared in anticipation of litigation doctrine. Again, the Landmark Ins. Co. and its progeny tell us this. Thus, while you may have duty to preserve it, you may not have a duty to disclose it. The result, of course, is that there is likely no prejudiced for failing to retain materials after a denial because those materials are likely exempt from discovery and will not assist the insured in evaluating the merits of the investigation and denial anyway.

The takeaway from Parauda is that carriers should still be mindful of managing and retaining documents (including internal communications outside the claim notes). Nevertheless, given the nuanced position of established discovery rules with insurers, it is, and will be, difficult for policyholders to exploit the loss or destruction of materials before or after the denial.

Steve

Steven E. Peiper

[email protected]

Even 100 Years Ago, Football was Considered a Dangerous Sport:

Times Herald

Olean, New York

27 Nov 1920

ELEVEN DEAD FROM FOOTBALL PRESENT YEAR

Number of deaths five greater than in 1919 and one greater than in 1918

CHICAGO, Nov. 27.—A football exacted a toll of eleven victims during the 1920 season which closed with the Thanksgiving Day’s games, according to reports to The Associated Press today.

The number of deaths was give greater than in 1919 and one above the list of two years ago. There were twelve lives lost during the 1917 season; eighteen in 1916 and fifteen in 1915.

The majority of the youths killed this season were high school players, who may have entered the game without sufficient physical training for so rough a sport and with only limited knowledge of the game. Only two of the dead were members of college aggregations; two were on college class teams. One boy, 12 years old, was killed in a game of the “sand lot” variety. Six of the victims were members of the high school eleven.

Defenders of the sport pointed to the fact that not a fatality occurred in the big universities of the country where the game is conducted under expert physical direction and coaching. The development of the open style of play, instead of the smashing game of a dozen years ago, and the improved, heavily padded uniforms and headgears, is eliminating much of the danger, according to football experts.

Wilewicz’ Wide-World of Coverage:

Dear Readers,

Happy Thanksgiving! We all know that this holiday will be unprecedented and unusual, but we’ll get through it. One positive thing to say about this Thanksgiving is that it will certainly be memorable. It’ll make a great, if somber, story to tell the great grandkids.

In our house, the holiday has always been low-key and the calm before the storm, namely the upcoming five-ish weeks of Christmas. As a kid, my parents would roast a duck (quicker to cook and fewer leftovers), and they continue to do that to this day. In my house as an adult, we’ve tried to cook full dinners in the past, but with just the three of us it was way too much work for the effort and way too much food for anyone. Instead, in recent years we’ve either gone to the local butcher or coop market for pre-made dinner (with all the trimmings, of course) and spent the day baking cookies and pies, and watching the parade and national dog show in our pajamas.

Now, this week in the Wide World of Coverage, the Circuit Courts continue to avoid coverage (ha, ha) so I’ve been scouring nationally for interesting cases to bring you. As you know, jurisdictionally in this column I typically focus on the Federal Circuit Courts, particularly our own tri-state Second Circuit. However, substantively, I particularly enjoy reading and writing about environmental coverage cases or cyber claims, though they don’t show up as often as I would like.

To that end, this week we bring you a cybercrime claim that implicated a title service company’s errors and omissions insurance policy. In Authentic Title v. Greenwich Insurance, an agent for title insurance policies was spoofed via email into transferring just over half a million dollars in real estate loan proceeds to a thief. When they brought the claim to their E&O carrier, however, it was disclaimed. The rationale for not covering the claim was that the policy contained an exclusion for claims arising out of theft, stealing, or misappropriation of funds. The court analyzed those terms in detail and found that the facts clearly implicated the exclusion. There no ambiguity in the terms and a theft of funds in this case did occur. As unfortunate as the circumstances where, there just was no coverage for the claim under that policy.

Until next time, have a great holiday,

Agnes

Agnes A. Wilewicz

[email protected]

Who Received Attention in College a Century Ago? Has Much Changed?

Buffalo Morning Express and

Illustrated Buffalo Express

Buffalo, New York

27 Nov 1920

Faculties of all U.S. universities get solar plexus

Professor says student must be morally and mentally deficient to get attention.

Special to The Buffalo Express.

Chicago, Ill., Nov. 26.—University faculties received a solar plexus today at the deft hands of Professor Rollow Walter Brown, of Carleton college, Northfield, Minn., in an address before the National Council of Teachers of English when he said:

“I have come to the conclusion that any student to received attention from the faculty of the average college, must be, to a certain extent, morally and mentally deficient.

“In the last ten years I have visited many colleges and I have attended a number of faculty meetings and while I have found that considerable time has been devoted to such questions as the number of fraternity dances to be given during a season, what hour at night the fudge kitchens in the girls’ dormitories shall remain open, and what size paddle may be used during the initiation of freshmen, never have I heard five minutes devoted to the question of the exceptional student destined to be a leader in whatever line of endeavor he shall follows.”

Great stress was laid by various speakers upon the vital necessity of speaking correct English. Professor Charles Swain Thomas of Harvard university warmly defended newspaper English. “In considering that newspapers are produced under excessive speed, and that reporters write their stories often times with but meager facts at hand and on first impressions, it is remarkable that we have such high class writing,” he said.

Barnas on Bad Faith:

Happy Thanksgiving:

I’ve got Thanksgiving as the second-best holiday of the year in my official holiday rankings (apologies to Independence Day, Memorial Day, and New Years who narrowly miss out on the Top 2). The meal is the best meal of the year by far. If I were going to pick one food item from the Thanksgiving dinner table that I simply cannot live without it would have to be stuffing. This brings up a question that we were discussing in the office today that I cannot answer: why do we only eat stuffing once a year? Stuffing is delicious. So why is it that I (and most people I know) only eat it on Thanksgiving? We eat turkey, mashed potatoes, and corn all year round. What did stuffing do to obtain one day per year status? Perhaps the exclusivity of stuffing is why I hold it in such high regard, but I would be willing experiment with that more going forward.

Aside from food, football is the other integral part of Thanksgiving. After the excitement of the Bills win over the Cowboys on Thanksgiving last year, this year’s games are a bit of a letdown. Steelers Ravens was looking like an excellent game, but it has been moved to Sunday due to COVID. That means we’re left with the 3-7 Texans against the 4-6 Lions and the 3-7 Cowboys against the 3-7 Football Team. At least the winner of the later game will have the most wins in the NFC East!

In my column this week I have a case from Florida where a bad faith claim was dismissed without prejudice as premature because there had been no determination of coverage. The court reminds us that a determination of coverage is necessary whether the claimant is pursuing a statutory first party bad faith claim or a common-law third-party claim.

That’s all for now.

Brian

Brian D. Barnas

[email protected]

Automobile Liability Insurance? It’s was Considered, by Some, an Injustice a Century Ago:

The Washington Times

Washington, District of Columbia

27 Nov 1920

LEGAL POINTS FOR AUTOMOBILE OWNER

Insurance May Be Snare for the

Unwary Motorist After Accident

By Our Legal Correspondent.

Automobile insurance represents the one class of insurance that remains in a state that can only be described as one of barbarous growth. As the result of the great injustices perpetrated in the name of law under cunningly contrived policies that provided a more nominal than actual protection to the insured, a standard fire insurance policy drawn with a due regard to the rights of both insurer and insured, has been made a legal requirement in many States, and is forced into use in other States through resulting competition and popular understanding of the snares of the policy that is not in standard form. Almost form the inception of workmen’s compensation schemes, employers’ liability policies were practically “lawed” into a form that gave the employee protection in fact as well as in name. In marine, life, and nearly all other branches of insurance, competition and publicity have created similar results. Only in the automobile line does it remain true that mushroom companies or established concerns with elastic consciences can sell insurance that the unwary motorist believes will give him protection, when in fact it more often is only a cover for the collection of premiums and the propagation of lawsuits…

Off the Mark:

Dear Readers,

Happy Thanksgiving everyone! This year will be different than past years as we will not be travelling and will be spending the holiday with only the immediate family. Despite this, we are all looking forward to spending a relaxing day together and eating until the tryptophan kicks in. Although we usually listen to the Thanksgiving classic, Alice’s Restaurant, on the ride to my aunt and uncle’s, we will have to make do by listening at home while we stuff ourselves on the hors d’oeuvres. Traditions are traditions.

As the courts seem to still be finding their groove as far as issuing decisions, I was unable to find any interesting construction defect decisions to report on this edition.

Stay safe everyone and enjoy the holiday…

Brian

Brian F. Mark

[email protected]

KKK Denies Race Prejudice:

New-York Tribune

New York, New York

27 Nov 1920

Americanism Called Creed of Ku Klux Klan

Colonel W. J. Simmons, Imperial Wizard of the Order, Gives Its Principles and Its Purposes

Denies Race Prejudice Respect for Law Is One of Its Chief Tenets, Declares Southern Chief

In response to a request from The Tribune for an outline of the aims and purposes of the revived Ku Klux Klan, Colonel William Joseph Simons, head of the order, telegraphed the following last night:

NEW ORLEANS, Nov. 26.—Answering your request for a statement from me concerning the purposes of the Knights of the Ku Klux Klan, I beg to say that the prime purpose of the organization is to develop Christian character, practice an honorable clannishness, protect the home and the chastity of womanhood and to teach, inculcate and exemplify an unselfish patriotism toward our glorious country, and to preserve and to proclaim the original and fundamental American ideals and institutions and to strengthen the power and prestige of the agencies of justice and order by inducing men properly to respect the majesty of the law. To maintain the peace and security of the people, even in the absence or inadequacy of the forces of law and order.

“The organization is non-sectional, non-partisan, non-political and non-sectarian, and the extent of its organized forces is as broad as the territorial jurisdiction of the Stars and Stripes and the purpose of its existence is everywhere the same. It never swerves from its purpose on account of sectional prejudices or local problems. Being the offspring and legitimate progeny of Anglo-Saxon civilization and fundamental American principles, it neither fosters nor condones any propaganda of religious intolerance or racial prejudices, as it stands for religious liberty and the rightful setting and functioning of the races of all the world.

Boron’s Benchmarks:

It is the day before Thanksgiving 2020 as I write this. While 2020 has been a very challenging year for most if not all of us, I nevertheless remain thankful for many, many blessings in my life. Not the least of my blessings is being in a profession I enjoy. I have the good fortune of working with professionals in my firm – and of course, many of you – who are remarkable individuals. For this edition of Boron’s Benchmarks, the Coverage Pointers beat monitoring and reporting on insurance coverage decisions of the high courts of the 49 states not named New York, I’ve selected for your consideration an opinion issued on November 20, 2020, by the Supreme Court of Hawaii in State Farm vs. Michael Mizuno.

The Mizuno opinion considers and applies a “chain-of-events” test to analyze whether a permissive user of his girlfriend’s vehicle had a “sufficient connection” to the insured vehicle to qualify as an “insured” entitled to the benefit of the uninsured motorist insurance afforded by his girlfriend’s auto policy. This Thanksgiving, I will personally be applying a “chain-of-events” analysis as I reflect upon the many blessings of my life, blessings both great and small. No doubt such analysis will give me pause to be extra thankful for certain individuals, such as my parents, siblings, wife, kids, friends, and co-workers. So many good-hearted, inspiring folks have done things large and small to cause personal and/or professional blessings in my life! Thanksgiving affords us a moment at least to consciously apply much needed perspective on our lives, and its many blessings. I appreciate the following sentiment, attributed to Benjamin Franklin, “Human felicity is produced not as much by great pieces of good fortune that seldom happened as by little advantages that occur every day.” I am thankful for the very generous share of little advantages I have experienced each day of my life. As I trust you are, too.

I hope you and yours have a great Thanksgiving. And, until next time, be well.

Eric

Eric T. Boron

[email protected]

Drinking is Dangerous for One’s Marriage:

The Buffalo Enquirer

Buffalo, New York

27 Nov 2020

MAN’S LIKING FOR BOOZE COSTS HIM

HIS WIFE AND HE MUST PAY BIG ALIMONY

(Special Telegram to The Enquirer.)

Chicago, Nov. 27,.—An “unlimited capacity” for liquor proved an expensive asset to Homer G. Howard, wealthy realty broker, when Judge Harry A. Lewis held it was sufficient cause for which to grant Mrs. Margaret Howard a divorce and an alimony settlement of $25,000. Mrs. Charlotte Warner of Seattle, Wash., a sister of Mrs. Howard, a witness, in response to a question by Attorney Charles E. Erbstein as to how much whisky Howard could drink at a time, said:

“Well, I never saw him when he wasn’t ready for another rink—he had an unlimited capacity.”

Barci’s Basics (On No Fault):

Hello Subscribers!

I hope you are all still staying healthy and safe! If you celebrated Thanksgiving, I hope you had a relaxing day full of good food. Personally, pumpkin pie is main reason I like Thanksgiving. Last time I asked what holiday traditions you have and if they are new or passed down. My family and I don’t have too many traditions, as we tend to keep the holidays on the simpler side. For me, my self-imposed holiday traditions start on Halloween, where I watch all 4 Halloweentown movies and eat pizza. Thanksgiving is usually the holiday we travel to see family, but that has obviously been interrupted this year, so fingers crossed we can get back to that next year! Then we celebrate Christmas, but don’t have any special traditions like getting matching pajamas, which is the tradition many of my friend’s families have. My tradition is to make the same four or five types of Christmas cookies every year and distribute them to friends. As for a family Christmas tradition, we usually order Chinese food on Christmas Eve and play a boardgame, so nothing too crazy. Although we don’t have many set traditions, the holidays are one of my favorite times of year and I look forward to continuing to hear from you all about your family’s traditions!

Sticking with the holiday theme, for next time consider: What is your best Christmas desert recipe? Share it with us!

On the no-fault front, I’ve got three cases for you out of the First Department, who are really cranking out no-fault decisions these last few weeks. Two of the cases discuss the importance of proof of properly mailed IME notices as a claimant’s failure to appear for an IME is a breach of a condition precedent to coverage. The other case is a reminder of the standard that must be met in order to overturn an arbitration award. Enjoy!

That’s all folks,

Marina

Marina A. Barci

[email protected]

Ex-Government Leader Sentenced to Jail:

Detroit Free Press

Detroit, Michigan

27 Nov 1920

EX-MAYOR SENTENCED

MAXIMUM OF 115 YEARS

Salt Lake City, Utah, Nov. 26.—Pleading guilty on 23 charges of misappropriation of public funds, Edmond A. Bock, former mayor of Salt Lake City, was sentenced this afternoon to an indeterminable term in the state prison of not to exceed five years on each charge. Bock was elected city auditor November 2, 1915, and he served in that position until he became mayor January 1, 1926, except time he was on leave as an auditor for the Red Cross in Europe.

Editor’s Note: 115 years? Nah, he was paroled, after restitution, the following year.

Ryan’s Capital Roundup:

Hello Loyal Coverage Pointers Subscribers:

In the year of our Lord, 2020, we have all been challenged mentally, emotionally, and physically. It has been the longest year on record, and in record time. On the threshold of 2021—the home stretch—I want to wish a Happy Thanksgiving to you and yours! Although we may not all be able to connect and visit one another physically, we must endeavor to reconnect with those that matter most.

Pick up the phone, send the email, set up the zoom, write the letter. Make someone’s day.

This issue, I have outlined the most recent consent order from DFS, concerning missteps taken by the NRA in breach of the New York Insurance Law and resolution of the matter following a three-year investigation. Additionally, DFS seeks comment before December 3 on pre-proposed draft modifications to public adjuster regulations under 11 NYCRR Part 25.

Until next time,

Ryan

Ryan P. Maxwell

[email protected]

A Century Ago, Immigration Limitations Proposed:

Reno Gazette-Journal

Reno, Nevada

27 Nov 1920

ASK LEGISLATION ON IMMIGRATION

WASHINGTON, Nov. 27.—Immigration legislation will be the most important problem to be considered at the approaching session of congress in the opinion of the legislative committee of the American Federal of Labor.

“With two million idle and thousands of immigrants pouring into the country every day,” says the report published today, “the dangers ahead of America are so serious that even the enemies of labor are fearful of the future.”

A bill prepared by the American Federation of Labor and proposing an investigation of the continued high cost of necessities will be presented in both houses early in the session, the committee said.

Hello all,

The holiday season has rapidly come upon us all. I don’t know that I am quite prepared for the quick transition the world makes from Thanksgiving to the Christmas season, one of these years it would be nice to take a few extra days to savor some pumpkin pie and have a few more plates of those Thanksgiving staples before moving on to the world or peppermint and hot cocoa. My wife, who is still on maternity leave, has already been decorating the house for winter (against my ardent objections). Her counter argument rests in the fact that we cannot go anywhere so we might as well have a cheery looking home. Which, I must say is a very valid point. I hope you and your families have had a happy and safe Thanksgiving and that the upcoming holiday season brings you all a bit of cheer.

This week I bring you a decision on a motion to dismiss from the Eastern District of New York. The issue of interest to me is that the court discusses a defendant’s ability to assert a counterclaim seeking declaratory judgment related to a separate (but related) policy to the policy plaintiff originally seeks relief under.

Happy Reading!

CJ

Charles J. Englert, III

[email protected]

Amazing, Nurses Now Must be Licensed, a Century Ago:

Star-Gazette

Elmira, New York

27 Nov 1920

Nurses of New York State!

The New York State Nurses Association calls your attention to the fact that the recent amendment to the Nurse Practice Act makes it compulsory that you register and obtain a license from the New York State Department of Education before Jan. 1, 1921.

This applies to all persons who practice as trained, certified, graduate or registered nurses or as trained attendants.

Every professional nurse should be able to show her annual registration card.

For further information apply to

Miss Elizabeth Burgess

Sec’y to the Board of Nurse Examiners

Dept. of Education, Albany, N.Y.

Dishing Out Serious Injury Threshold:

Dear Readers,

Happy Thanksgiving to all. I hope everyone has a safe and healthy Thanksgiving with all family, even with those who you may not be able to share it with this year. Despite all of the difficulties of 2020, we all have a lot to be thankful for.

In the Serious Injury Threshold world, we have a Second Department case and a First Department case both dealing with expert reports. In the Second Department case, defendant’s failure to opine as to an alternative cause of plaintiff’s injuries was insufficient to defeat plaintiff’s motion for summary judgment. Conversely, the First Department case found that plaintiff’s expert inability to rebut defendant’s expert opinion as to an alternative cause of plaintiff’s injury was fatal to plaintiff’s claim.

Stay safe,

Michael

Michael J. Dischley

[email protected]

Horrors, Massachusetts to Require Drivers to Pass Driver’s Test:

The Buffalo Enquirer

Buffalo, New York

27 Nov 1920

MASSACHUSETTS AUTO REGISTRAR

WANTS DRIVERS TO PASS EXAMINATIONS

(By the International News Service.)

Boston, Nov. 27.—Declaring that he no longer desires to bear the grave responsibility of turning loose on the highway every year thousands of incompetents to kill and maim, State Registrar of Motor Vehicles Goodwin today decided that no person in Massachusetts shall hereafter be granted an original license to operate a motor vehicle, until he has passed an examination adequate to demonstrate his fitness to drive a car.

The announcement of this drastic policy was accompanied by a statement by Goodwin that 16,000 of the operators who obtained licenses in 1919 were absolutely unfit to drive a car.

Lee’s Connecticut Chronicles:

Dear Nutmeg Newsies:

Greetings from Sunny Florida! This Thanksgiving holiday, I packed up my Connecticut COVID bubble and headed for the open road, off to my parents’ Florida COVID bubble. Social distancing in 80° sunshine is far superior to temperatures hovering about the freezing mark in Connecticut. With remote court appearances and Zoom depositions, virtual learning for the kids, who knows when, or if, we’ll ever go back.

To all our loyal readers, we wish you a happy and safe holiday.

Lee

Lee S. Siegel

[email protected]

Broom Sticks as Assault Weapons:

The Wilkes-Barre Record

Wilkes-Barre, Pennsylvania

27 Nov 1920

BROOMSTICK ASSAULT

Causes Judge Fuller to Moralize on

Question of Infuriated Females

In deciding against the defendant in the case of Michael Spudis against Frances Moses, and assault with a broomstick during a dispute over a line fence, Judge Fuller moralizes on the deadliness of the infuriated female, saying:

“The elements involved in this case are, (1) a line fence, (2) an infuriated female on each side of the line fence disputing its location, (3) a broomstick in the hands of one infuriated female applied to the person of the other infuriated female in the heat of altercation, inflicting uncomfortable but not fatal physical consequences, (4) prosecution of the infuriated female wielding the broomstick, by the infuriated female upon whom it was wielded, (5) defendant’s plea of non vult contendere, without prejudice, (6) testimony concerning but not illuminating the controversy.

“We approve the plea of non vult contendere, because the case if submitted to a jury might properly have resulted in a verdict of guilty. But we make generous allowance for the human infirmities of an infuriated female’s disposition. If the broomstick had been held on the other side of the fence, the shoe would have been on the other foot and the bruises upon the other body. The prosecutrix had the spirit but not the broomstick to do unto her assailant as her assailant did unto her. Sentence is suspended on condition that defendant’s husband pay the costs, and that the broomstick be surrendered to the victim of its violence.”

Cara’s Canadian and Cross-Border Connections (with Heather Sanderson):

Hello Subscribers,

Wallpaper, wood paneling, and ceiling tiles all removed! We are waiting to proceed with some other larger projects, but in the meantime, I have been learning a lot about all bathroom related issues, including exhaust fans, sink faucets, and toilets… What I’ve learned so far: the importance of attic access for exhaust fans; exhaust fans are becoming so teched out that I’m only slightly concerned about a Hal situation evolving with an exhaust fan that’s too smart; the difference between a pop up drain and a push pop drain; calculating sufficient room for a sink trap (after learning what they are, I will forever be concerned about the condition of a trap); confirming one has sufficient space for the rough-in size for a toilet; elongated versus round toilet bowls; one piece compared to two piece toilets; etc. That’s my personal life in a nutshell and we are making progress and all this effort will make me more appreciative of the end result.

As for Thanksgiving… Whether you’re one who mixes all the food together (like me) or you like to keep your foods separate from each other, I hope you all are staying safe and enjoy a cozy, post-Thanksgiving meal nap! Happy Thanksgiving!

Cara A. Cox

[email protected]

Heather Sanderson

Sanderson Law (Alberta, Canada)

[email protected]

Headlines from this week’s issue:

KOHANE’S COVERAGE CORNER

Dan D. Kohane

[email protected]

- MV-104 (Police Accident Report) is Enough to Justify a Framed-Issue Hearing on Existence of Insurance on Offending Car in Uninsured Motorist Application

- Excess Carrier Does Not Drop Down to Fill Gap Left by Underlying Carrier’s Rescission, Either for Principal or Interest

- Both Auto and CGL Carrier had Defense Obligations

- Important Decision: As Legislative History and Language of New York Notice-Prejudice Statute Clearly Indicates, Claims Made Policies Can Require Timely Reporting and Absence of Prejudice is Irrelevant to Policy Terms. Moreover, First Department Uphold Right to Recoup Defense Costs, if Reserved in Coverage Position Letter

PEIPER ON PROPERTY (and POTPOURRI)

Steven E. Peiper

[email protected]

Property

-

Definition of Collapse in Means What it Says; Litigation Hold Not Necessary Prior to Decision to Deny Coverage

Potpourri

- Trial Court Improperly Precluded Expert from Offering Opinion Testimony Based upon Facts Already in the Record

- Class Action Required a Least 40 Members to Satisfy Numerosity Threshold

DISHING OUT SERIOUS INJURY THRESHOLD

Michael J. Dischley

[email protected]

- Defendant’s Expert Failure to Opine as to Alternative Cause of Injuries Failed to Shift Burden to Plaintiff to Explain any Gap in Treatment

- Defendant’s Expert Showing that Plaintiff’s Injuries Were Not Related to Subject Accident are Fatal to Plaintiff’s 90/180 Day Claim

WILEWICZ’S WIDE WORLD OF COVERAGE

Agnes A. Wilewicz

[email protected]

- New Jersey Federal District Court Finds No Coverage Under E&O Policy in Email Spoofing Claim, Where Policy Excluded Coverage for Theft, Stealing, or Misappropriation of Funds

BARNAS ON BAD FAITH

Brian D. Barnas

[email protected]

- First and Third-Party Bad Faith Claims Require a Determination of Coverage before they can Proceed under Florida Law

LEE’S CONNECTICUT CHRONICLES

Lee S. Siegel

[email protected]

- Minor’s Participation Agreement and Release Inoperative

OFF THE MARK

Brian F. Mark

[email protected]

- Happy Thanksgiving!

BORON’S BENCHMARKS

Eric T. Boron

[email protected]

- Supreme Court of Hawaii: Auto Insurance – Uninsured Motorist Coverage – “Chain of Events” Test

BARCI’S BASICS (ON NO FAULT)

Marina A. Barci

[email protected]

- Claimant’s Failure to Appear at Scheduled IMEs Warrants Denial of No-Fault Benefits to Assigned Provider

- Master Arbitration Award Confirmed As It Was Not Arbitrary or Capricious

- Claimant’s Failure to Appear for Duly Scheduled IMEs Results in Disclaimer of Coverage for the Medical Providers Who Provided Services to the Claimant

RYAN’S CAPITAL ROUNDUP

Ryan P. Maxwell

[email protected]

Regulatory Wrap-Up

- Department of Financial Services Announces Settlement with NRA To Resolve Case Involving Violations of New York Insurance Law

- DFS Seeks Review and Comment on Draft Regulation Modifying Public Adjuster Regulations Including Referrals and Compensation

CJ on CVA and USDC(NY)

Charles J. Englert III

[email protected]

- Counterclaims for Declaratory Judgment to Determine Parties’ Rights Under a Separate but Related Policy Will Be Dismissed When Parties Will Be Granted the Ability to Determine Those Rights through the Adjudication of the Initial Claims

CARA’S CANADIAN AND CROSS-BORDER CONNECTIONS (WITH HEATHER SANDERSON)

Cara A. Cox

[email protected]

Heather Sanderson

Sanderson Law (Alberta, Canada)

[email protected]

- Named Insured May Not Seek to Subrogate Settlement from an Additional Insured Where an Exclusion Does Not Affect a Waiver of Subrogation Provision

Enjoy each other.

Hurwitz & Fine, P.C. is a full-service law firm providing legal services throughout the State of New York and providing insurance coverage advice and counsel in Connecticut.

In addition, Dan D. Kohane is a Foreign Legal Consultant, permit no. 000241, issued by the Law Society of Upper Canada, and authorized to provide legal advice in the Province of Ontario on matters of New York State and federal law.

NEWSLETTER EDITOR

Dan D. Kohane [email protected]

ASSOCIATE EDITOR

Agnes A. Wilewicz [email protected]

INSURANCE COVERAGE/EXTRA CONTRACTUAL LIABILITY TEAM

Dan D. Kohane, Chair [email protected]

Steven E. Peiper, Co-Chair [email protected]

Michael F. Perley

Agnieszka A. Wilewicz

Lee S. Siegel

Brian F. Mark

Diane L. Bucci

Brian D. Barnas

Eric T. Boron

Marina A. Barci

Ryan P. Maxwell

Charles J. Englert

Cara A. Cox

Diane F. Bosse

Joel R. Appelbaum

FIRE, FIRST-PARTY AND SUBROGATION TEAM

Steven E. Peiper, Team Leader [email protected]

Michael F. Perley

Eric T. Boron

Brian D. Barnas

NO-FAULT/UM/SUM TEAM

Dan D. Kohane [email protected]

Marina A. Barci

APPELLATE TEAM

Jody E. Briandi, Team Leader

[email protected]

Diane F. Bosse

Topical Index

Kohane’s Coverage Corner Peiper on Property and Potpourri

Dishing out Serious Injury Threshold

Wilewicz’s Wide World of Coverage Barnas on Bad Faith

Lee’s Connecticut Chronicles Off the Mark

Ryan’s Capital Roundup CJ on CVA and USDC(NY)

Cara’s Canadian and Cross-Border Connections (with Heather Sanderson)

Dan D. Kohane

11/25/20 Allstate Insurance Company v. Robinson

Appellate Division, Second Department

MV-104 (Police Accident Report) is Enough to Justify a Framed-Issue Hearing on Existence of Insurance on Offending Car in Uninsured Motorist Application

This was an application to permanently stay arbitration of a claim for uninsured motorist benefits.

In May 2016, a vehicle driven by Robinson, was struck from behind by another vehicle. According to Robinson, the driver of the offending vehicle identified herself as Karen Randall and provided Robinson with her contact information. Robinson asserts that Randall left the scene of the accident before the police arrived. Robinson made a claim to GEICO, supposedly the insurer of the offending vehicle, GEICO denied Robinson's claim, stating that its insured was named Lewis, and that there was no evidence that Lewis was involved in the accident.

So, Robinson demanded arbitration of her claim for uninsured motorist benefits from Allstate, her insurer. Allstate then commenced this proceeding seeking, inter alia, a permanent stay of arbitration of Robinson's claim. A framed-issue hearing was requested by the lower court denied the request.

Allstate submitted a copy of the MV-104 motor vehicle accident report signed by Robinson, which included the license plate number of the offending vehicle, and a copy of an MVR vehicle record report with the results of a license plate search demonstrating that the offending vehicle was owned by Lewis and insured by GEICO.

The party seeking a stay of arbitration has the burden of showing the existence of sufficient evidentiary facts to establish a preliminary issue which would justify the stay. Then the burden shifts.

Allstate’s document demonstrated the existence of sufficient evidentiary facts to establish a preliminary issue justifying a temporary stay. The MV-104 motor vehicle accident report and the MVR vehicle record report with the results of the license plate search for the plate number provided by Robinson, Allstate made a prima facie showing that the offending vehicle involved in the subject accident had insurance coverage with GEICO at the time of the accident.

In opposition, Robinson and the GEICO respondents raised questions of fact as to whether the offending vehicle was involved in the subject. A framed-issue hearing is ordered.

11/24/20 Chen v. Insurance Company of the State of Pennsylvania

New York Court of Appeals

Excess Carrier Does Not Drop Down to Fill Gap Left by Underlying Carrier’s Rescission, Either for Principal or Interest

Does an excess insurer have an obligation to pay interest on an underlying personal injury judgment after the primary policy was voided? “No,” says the highest court of the state.

Chen was injured at a construction site and sued the general contractor Kam Cheung Construction, Inc. (“Kam Cheung”). At the time, Kam Cheung maintained both primary and excess liability insurance policies: a primary policy with a liability limit of $1 million per occurrence from Arch Specialty Insurance Company (Arch) and an excess policy with $4 million per occurrence in coverage from defendant Insurance Company of the State of Pennsylvania (ICSOP).

Chen secured a personal injury judgment of $2,330,000 plus $396,933.70 in prejudgment interest against Kam Cheung. In the meantime, Arch successfully rescinded the primary policy because of material misrepresentations.

Chen then sued ICSOP, seeking a determination that the excess insurer was obligated to pay the entire underlying damages award. ICSOP answered, raising various defenses and contending it had validly disclaimed coverage.

The question below was whether ICSOP’s disclaimer was valid and, if not, did ICSOP drop down to fill the gap provided by the underlying policy’s rescission. Plaintiff moved for summary judgment seeking a declaration that ICSOP's disclaimer of coverage was invalid and an order directing ICSOP to satisfy the underlying judgment. In opposition, ICSOP conceded both that its disclaimer of coverage was unenforceable due to its failure to serve plaintiff and that it was obligated to provide some coverage, but argued that its policy did not "drop down" to fill the gap created by the voided Arch Policy.

On appeal in this Court, plaintiff argues that ICSOP was obligated to pay all prejudgment and post judgment interest on the entire underlying personal injury award based on its "Ultimate Net Loss" provision, which plaintiff interprets as saddling ICSOP with all covered losses over the Arch Policy's $1 million liability limit. Further, plaintiff contends that the excess insurer was obligated to pay all prejudgment and post judgment interest on the underlying personal injury judgment (regardless of whether that interest would have been paid by Arch under the Arch Policy) pursuant to the "follow form" language in the excess policy, suggesting that ICSOP could avoid interest obligations only if it included language in the Ultimate Net Loss provision specifically addressing interest. The Court of Appeals rejects both arguments finding that the excess policy covered only losses in excess of those that would have been paid by Arch under the Arch Policy.

ICSOP's payment obligations are described in the excess policy's "Coverage" provision, which states that ICSOP will pay "Ultimate Net Loss in excess of the Underlying Insurance as shown in Item 4 of the Declarations." "Ultimate Net Loss" is defined in that policy as "the amount payable in settlement of the liability of the Insured after making deductions for all recoveries and for other valid and collectible insurance, excepting however the Underlying Insurance shown in Item 4 of the Declarations."

In turn, Item 4 of the Declarations cites an attached "Schedule of Underlying Insurance," which references the Arch Policy generally (policy number, policy period, limits of insurance and type of coverage) without excluding any type of coverage provided therein (such as Supplementary Payments coverage). Thus, based on the ICSOP Policy's Coverage and Ultimate Net Loss provisions, the excess policy covers only losses in excess of those that would have been paid by Arch under the Arch Policy. Accordingly, ICSOP is not obligated to pay the interest Arch agreed to pay as Supplementary Payments.

Indeed, under the excess policy, Kam Cheung was to maintain underling insurance and if it did not ICSOP would "only be liable to the same extent that [ICSOP] would had [Kam Cheung] fully complied."

Moreover, the Maintenance of Underlying Insurance provision clearly states that ICSOP's coverage would be unaffected by Kam Cheung's failure to maintain the required $1 million in primary liability coverage, which is effectively what occurred here. The ICSOP Policy's "Bankruptcy or Insolvency" condition further clarifies that, despite the "bankruptcy, insolvency, or inability to pay" of either Kam Cheung or Arch, ICSOP would not "drop down" and replace Arch or "assume any obligation within the Underlying Insurance area." Payment of some prejudgment and all post judgment interest over the $1 million liability limit is an obligation "within the Underlying Insurance area."

Plaintiff sought to treat interest payments on the underlying award as falling within or reducing the Arch Policy's $1 million liability limit, which is contrary to the plain language of the Arch Supplementary Payments provision and the ICSOP Policy's Coverage, Ultimate Net Loss, and Maintenance of Underlying Insurance provisions. To do so would be inconsistent with the language chosen by the parties to the insurance contracts.

The inclusion in the ICSOP Policy of a standard "follow form" provision does not alter this result.

Editor’s Note: Strong and separate dissenting opinions would have ruled differently.

11/24/20 Wesco Insurance Company v. Hellas Glass Works Corp

Appellate Division, First Department

Both Auto and CGL Carrier had Defense Obligations

Although the duty is primarily determined by the complaint, the Court of Appeals has held that “wooden application of the 'four corners of the complaint' rule would render the duty to defend narrower than the duty to indemnify".

Based on the pleadings in the underlying personal injury action and third-party action, as well as documents and testimony, and the fact that discovery and depositions in the underlying action are still ongoing, it cannot be said that there is no possible factual or legal basis on which either Wesco's automobile policy or MBIC's general liability policy might eventually be held to afford indemnity coverage. Accordingly, the court allowed "the pro rata sharing of defense costs may be ordered when more than one policy is triggered by a claim".

In reviewing the decision from the lower court, where the pleading alleged a premises liability claim, discovery revealed that the accident may have arisen out of the unloading of a truck. Hence, both carriers were required to defend, and they were equally responsible for defense costs.

11/17/20 Certain Underwriters at Lloyd's v. Advance Transit Co., Inc.

Appellate Division, First Department

Important Decision: As Legislative History and Language of New York Notice-Prejudice Statute Clearly Indicates, Claims Made Policies Can Require Timely Reporting and Absence of Prejudice is Irrelevant to Policy Terms. Moreover, First Department Uphold Right to Recoup Defense Costs, if Reserved in Coverage Position Letter.

Claims Made policies are not subject to “prejudice” requirements for notice. A claims-made policy can set a definite time frame for reporting claims, irrespective of prejudice, which can include "the policy period, any renewal thereof, or any extended reporting period." The insured reported the claim to Underwriters outside the policy period and the extended reporting period and therefore, the claim was untimely.

New York law further permits insurers to provide their insureds with a defense subject to "a reservation of rights to, among other things, later recoup their defense costs upon a determination of non-coverage. In its reservation of rights letter, plaintiff reserved the right to recover payments made by Underwriters including payments for defense costs and expenses, attorneys' fees, and costs of suit.”

PEIPER ON PROPERTY (and POTPOURRI)

Steven E. Peiper [email protected]

Property

11/18/20 Parauda v. Encompass Ins. Co. of Am.

Appellate Division, Second Department

Definition of Collapse in Means What it Says; Litigation Hold Not Necessary Prior to Decision to Deny Coverage

Plaintiffs’ claim was centered around extensive decay found in and throughout the wooden framing of their brick home. The decay was caused by water infiltration over a long period of time. Encompass eventually denied the claim on the basis that coverage for damage resulting from decay/rot was excluded. In addition, as the home was still standing it did not satisfy the definition of collapse as set forth in the policy.

The trial court found in favor of plaintiffs, and the Appellate Division reversed. In so holding, the Court noted first that while a carrier bears the burden of establishing the application of a certain exclusion, the duty to establish coverage falls squarely upon the shoulders of the insured. On the Record presented in this case, the Court noted that Encompass met its burden of establishing “various” exclusions were applicable to claim.

In addition, plaintiffs were unable to meet their burden of demonstrating that the coverage extension for collapse applied. The policy language at issue required “an abrupt falling down or caving in of…any part of [the property].” Here, the evidence submitted by Encompass demonstrated that the home never “fell down or caved in,” and thus plaintiffs could not demonstrate that a “collapse” had occurred. In so holding, the Court further rejected plaintiffs’ proffered expert because he, likewise, failed to identify “any portion of the property [that] was no longer standing or identify any specific damage which fell within the definition of a covered ‘collapse’.”

In addition to the collapse/coverage issues, the Court also addressed plaintiffs’ claims for discovery sanctions based upon spoliation of evidence. Plaintiffs alleged that Encompass failed to institute a litigation hold to prevent the loss of emails and documents related to their claim.

In affirming the trial court’s denial of plaintiffs’ motion for sanctions, the Court noted that Encompass decided to deny coverage on October 17, 2014. As such, the Court noted that Encompass should have “reasonably anticipated litigation” on that date. Resultingly, the failure to institute a “litigation hold” on that date supports an inference that materials discarded thereafter may have been relevant. Nevertheless, Encompass “rebutted the inference of relevance by establishing the evidence allegedly destroyed due to the lack of a litigation hold ‘would not support the plaintiffs’ claims.”

Potpourri

11/18/20 Gubitosi v. Hyppolite

Appellate Division, Second Department

Trial Court Improperly Precluded Expert from Offering Opinion Testimony Based upon Facts Already in the Record

This matter arises out of a rear-end collision which resulted in injuries to Mr. Gubitosi. Where the issue of negligence was resolved on summary judgment, the matter proceeded to a damages only trial at the conclusion of which the jury returned verdict finding that plaintiff sustained a serious injury and accordingly awarded damages.

Defendant moved to set aside the verdict on the basis of reversible error by the trial judge. Apparently, the trial judge precluded defendant’s expert witness from providing his opinion on documents already in evidence and likewise prohibited the expert from offering his opinion on the issue of causation. In reversing the trial court’s decision, the Appellate Division noted that an expert is permitted to testify on facts to which he or she has personal knowledge. An expert is also permitted to testify about evidence (real or testimonial) that is in evidence regardless of whether he or she had personal knowledge. In addition, despite not addressing causation in his report, the expert in this case likewise should have been permitted to offer opinion testimony because “causation was implicit in the question of damages.”

Defendant also requested a new trial based upon prejudice they allegedly sustained when plaintiff disclosed, for the first time at trial, that he sustained a neck injury approximately one and a half years before the incident involving defendant. The Court recognized that plaintiff’s failure to disclose relevant injury history caused prejudice to the defendant, and while defendant did not properly preserve his appellate rights on this issue the Court noted that a new trial was appropriate in the interests of justice.

11/17/20 Agolli v. Zoria Hous., LLC

Appellate Division, First Department

Class Action Required a Least 40 Members to Satisfy Numerosity Threshold

The trial court denied plaintiff’s application for class certification due to a lack of numerosity where it determined that plaintiff had not demonstrated more than 40 members in the putative class. While the Appellate Division affirmed that a class must include at least 40 people to meet the threshold, the matter was remanded for further discovery inquiring into the exact amount of people qualifying in this proposed class.

DISHING OUT SERIOUS INJURY THRESHOLD

Michael J. Dischley

11/12/20 Ledee v. Stephanie Matthes

Appellate Division, Second Department

Defendant’s Expert Failure to Opine as to Alternative Cause of Injuries Failed to Shift Burden to Plaintiff to Explain any Gap in Treatment

In an action to recover damages for personal injuries, the plaintiff appeals from an order of the Supreme Court, Nassau County (Sharon M.J. Gianelli, J.), entered August 16, 2017. The order granted the defendant's motion for summary judgment dismissing the complaint on the ground that the plaintiff did not sustain a serious injury within the meaning of Insurance Law § 5102(d) as a result of the subject accident.

The plaintiff initially commenced this action to recover damages for personal injuries that he allegedly sustained in a motor vehicle accident on April 8, 2014. The defendant moved for summary judgment dismissing the complaint on the ground that the plaintiff did not sustain a serious injury within the meaning of Insurance Law § 5102(d) as a result of the subject accident.

On appeal, the Appellate Division found that the defendant met her prima facie burden of showing that the plaintiff did not sustain a serious injury within the meaning of Insurance Law § 5102(d) as a result of the accident. Additionally, the defendant submitted competent medical evidence establishing, prima facie, that the alleged injuries to the cervical and lumbar regions of the plaintiff's spine did not constitute serious injuries under either the permanent consequential limitation of use or significant limitation of use categories of Insurance Law § 5102(d). In opposition, however, the plaintiff raised a triable issue of fact as to whether he sustained serious injuries to the cervical and lumbar regions of his spine under the permanent consequential limitation of use and significant limitation of use categories of Insurance Law § 5102(d).

Since the defendant's expert did not opine as to the cause of the alleged injuries to the cervical and lumbar regions of the plaintiff's spine, the defendant failed to establish, prima facie, that those alleged injuries were not caused by the accident. Thus, the burden did not shift to the plaintiff to raise a triable issue of fact regarding causation or to explain any gap in treatment as to the cervical and lumbar regions of his spine.

Accordingly, the Appellate Division found that the Supreme Court should have denied the defendant's motion for summary judgment dismissing the complaint.

11/12/20 Tarjavaara v. Lynda Considine

Appellate Division, First Department

Defendant’s Expert Showing that Plaintiff’s Injuries Were Not Related to Subject Accident are Fatal to Plaintiff’s 90/180 Day Claim

In an action to recover damages for personal injuries, the plaintiff appeals from an order of Supreme Court, New York County (Adam Silvera, J.), entered July 5, 2019, which, granted defendants' motion for summary judgment dismissing the claim of serious injury to the right knee and the 90/180-day claim pursuant to Insurance Law § 5102(d).

Defendants established prima facie that plaintiff did not sustain an injury that resulted in the "permanent consequential limitation" or "significant limitation" of use of his right knee. Although defendants' medical expert noted some limitations in range of motion in plaintiff's right knee, he attributed this to plaintiff's preexisting, degenerative knee condition and obesity, and found no objective evidence of disability. In addition, the expert relied on plaintiff's own post-accident X-ray showing no traumatic changes and an MRI of his right knee, taken 13 days after the accident, showing tri-compartmental osteoarthritis, cartilage thinning, and other degenerative findings.

In opposition, plaintiff failed to raise an issue of fact. The plaintiff’s expert report did not explain his conclusion that plaintiff's right knee symptoms stemmed from the subject accident, rather than from his osteoarthritis. Furthermore, the physician failed to reconcile other medical records showing an absence of significant limitations in plaintiff's right knee shortly after the accident.

Defendants' showing that plaintiff's injuries were not causally related to the accident defeats his 90/180-day claim. In addition, plaintiff's bill of particulars alleges that he was confined to his bed and home for only 49 days after the accident, and there is only his testimony, and no objective medical evidence, to substantiate his claim that he was unable to work or perform activities of daily living.

Accordingly, the Appellate Division unanimously affirmed the Supreme Court decision.

WILEWICZ’S WIDE WORLD OF COVERAGE

Agnes A. Wilewicz [email protected]

11/17/20 Authentic Title Services v. Greenwich Insurance Company

United States District Court, District of New Jersey

New Jersey Federal District Court Finds No Coverage Under E&O Policy in Email Spoofing Claim, Where Policy Excluded Coverage for Theft, Stealing, or Misappropriation of Funds

Authentic Title Services was insured under an errors and omissions policy with Greenwich Insurance. At the time, Authentic was an agent for title insurance policies underwritten by Fidelity National Title Insurance Company. In early 2016, Authentic suffered losses as a result of an email spoofing scam in which Authentic was duped into sending real estate loan proceeds to a fraudulent account.

At that time, they were acting as the title agent and settlement agent for a real estate transaction for property in South Orange, New Jersey. Quicken Loans was the mortgage lender, and it transferred the loan proceeds to Authentic on March 20, 2016, the day before the scheduled closing date. Authentic then deposited the funds into a settlement account at TD Bank. Despite the transaction, the funds remained the property of Quicken. The closing was postponed, and emails went back and forth between Mark Maryanski of Authentic, Brittany Clark of Quicken, and others concerning return wire instructions for Authentic to use in sending the loan proceeds back. According to the Court:

On April 4, 2016, Maryanski received an email from “[email protected]” (an email address different from Clark’s legitimate email address by one letter), with what appeared to be wiring instructions for the return of the funds. The email was actually from an unknown third party posing as Clark, and it directed Maryanski to transfer the funds to a specified account at Chase Bank (the “Fraudulent Account”) and to confirm only by email. The email also copied two spoofed email addresses that were very similar to legitimate email addresses used by other Quicken employees involved with the real estate transaction. On April 5, 2016, Maryanski received an email from yet another spoofed email address, purporting to be from yet another Quicken employee, Aloria Harris, and which was one letter off from her legitimate email address. The email again requested that Maryanski wire the funds to the Fraudulent Account. That same day, Maryanski transferred the Quicken loan proceeds of $480,750.96 to the Fraudulent Account. He sent email confirmation to the spoofed email address for Ms. Harris and received an acknowledgement in response from what the parties refer to as the “fraudster.” By April 12, 2016, it became clear to both Maryanski and Quicken that the funds had been diverted to the Fraudulent Account. Around April 14, 2016, Maryanski reported the incident to Authentic’ s bank, TD Bank. He also reported it to Fidelity, which issued title insurance for the real estate transaction, to the FBI, and to JP Morgan Chase Bank. The diverted funds were withdrawn by an unknown party and never recovered.

Following the transactions, Authentic filed a claim with Greenwich. Quicken was indemnified by Fidelity for the loss and provided new funds for the real estate transaction, which then closed. However, Greenwich notified Authentic that it was denying the claim as to them, citing an exclusion: “14. based on or arising out of:

a. the commingling, improper use, theft, stealing, conversion, embezzlement or misappropriation of funds or accounts[.].” They further wrote that: “This claim arises from a theft, stealing, conversion and/or misappropriation of funds. As such, the claim is not covered by the policy as it arises from conduct clearly excluded under this Policy. Consequently, [Greenwich] is therefore denying defense and indemnity coverage for this matter.”

Under a heading entitled “Additional Coverage Issues,” the letter went on to refer to several additional exclusions, the first excluding coverage for any claim: “8. based on or arising out of alleged criminal, intentionally wrongful, fraudulent or malicious acts or omissions. However, this exclusion shall not apply to defense expenses or the Company’s duty to defend a claim unless and until there is an admission by, finding of fact, or final adjudication against any Insured as to such conduct, at which time the Insured shall reimburse the Company for all defense expense incurred. Additionally, this exclusion will not apply to any Insured who:

a. did not participate or acquiesce in such act, error or omission; b. had no knowledge of or reason to suspect such an act, error or omission; and c. immediately notified the Company in writing after obtaining knowledge of such act, error or omission.”

In 2017, Fidelity demanded payment directly from Authentic in an amount in excess of $520,000. Authentic again asked Greenwich for coverage, which again was denied. Litigation ensued. At the appellate level, at issue was primarily exclusive 14, as above, which precluded coverage for any claim based on or arising out of the theft or misappropriation of funds. The exclusion’s plain language, the court wrote, was clearly applicable in this case. The provision stated that there was no coverage for claims “based on or arising out of” theft, stealing, conversion, or misappropriation of funds. Since “arising out of” has been defined by the state’s highest court as “originating from, growing out of or having a substantial nexus” to something, it was applicable here. Indeed, “Fidelity’s claim against Authentic and Authentic’s consequent claim for coverage under its policy with Greenwich undeniably originated from, grew out of, or had a substantial nexus to funds belonging to Quicken that were transferred into the Fraudulent Account and then were withdrawn by a person or entity other than Quicken and were never recovered”.

While the parties debated over whether the terms “theft”, “stealing”, “conversion”, or “misappropriation” applied, ultimately the court found that the standard definitions of those terms were unambiguous. It was either the wrongful depriving of another of its property, or the wrongful exercise of dominion or control over another’s property, or a wrongful taking. No matter which particular term was analyzed, at least one of them applied to the facts of this case. A genuine ambiguity only exists where there are two or more distinct definitions for a term, or where the phrasing of the policy is so confused that the average person would not be able to make out the boundaries of coverage. This was not the case here. The plain language of the exclusion dictated the applicability to this spoofing and stealing scheme. The language was not ambiguous, and thus applied, there was no coverage for the unfortunate claim.

Brian D. Barnas

11/11/20 Razaqyar v. Integon National Insurance Company

United States District Court, Middle District of Florida

First and Third-Party Bad Faith Claims Require a Determination of Coverage before they can Proceed under Florida Law

Integon issued a commercial auto insurance policy to Metal Building Installers. In February 2011, Ms. Razaqyar was rear-ended by a car owned by Jessica Cramer that was being driven by an employee of Metal Building Installers.

Integon rescinded the policy based on a named-driver exclusion.

Plaintiffs sued Cramer and Metal Building Installers in state court. Cramer and the Metal Building Installers tendered the claim to Integon, but Integon declined to defend the state court action. Cramer and Metal Building Installers defaulted and did not appear at the jury trial. A final judgment was entered against them in the amount of $797,610.00.

Plaintiffs then commenced this action against Integon asserting claims for declaratory relief and bad faith. Integon moved to dismiss both causes of action.

The court denied the motion to dismiss the declaratory judgment claim. Integon argued that the claim should be dismissed because it had rescinded the policy and the complaint did not allege the rescission was improper. However, the court construed the complaint as challenging Integon’s decision to rescind the policy and deny coverage. Accordingly, the claim was allowed to go forward.

In contrast, the bad faith claim was dismissed without prejudice. Under Florida law, it is inappropriate to litigate a bad faith claim until after an underlying coverage dispute is resolved. Both statutory first party and common law third party bad faith claims require a determination of coverage before they can be prosecuted. While a determination of liability was made in the state court case, there was no determination of coverage. Accordingly, the bad faith claim was dismissed without prejudice as not ripe.

LEE’S CONNECTICUT CHRONICLES

Lee S. Siegel

10/21/20 Chelsea Zeolla PPA Anthony Zeolla v. Flight Fit N Fun, LLC

Superior Court of Connecticut, Hartford

Minor’s Participation Agreement and Release Inoperative

The Connecticut courts must have started their Thanksgiving break early as we, once again, have no insurance coverage cases to report. Instead, we’ll take a look at a case of first impression in Connecticut: whether a third party is authorized to waive the rights of a child by apparent authority in instances in which the child's parents may not lawfully waive the same rights. If you read the headline, you already know the answer.

The Defendant, Flight Fit N Fun, operates an indoor trampoline park in New Britain. Trampoline parks are some of the most popular forms of entertainment for people in the United States. As of May 2019, there were more than 600 trampoline parks in the United States. Like most athletic entertainment venues, Flight required patrons to sign a release. The Participation Agreement, Release and Assumption of Risk Agreement (Release), waived the participants’ constitutional rights to sue Flight in court, instead requiring arbitration of all disputes.

Complicating this case was the fact that the plaintiff was a minor who accompanied a friend and the friend’s adult sibling, Carlos Rivera, to the park. On November 7, 2017, the plaintiff entered Flight and Mr. Rivera signed the Release on behalf of plaintiff. The Release required Mr. Rivera to represent that he was the parent or legal guardian of the child to whom the agreement pertained, or that he otherwise had the legal authority to sign the Release on the relevant minor child's behalf. The Release mandates that “[a]ny controversy between the parties ... arising out of or relating to use of the facilities ... shall be submitted to and be settled by final and binding arbitration ...”

Well, as we know, the plaintiff was injured and sued Flight in Superior Court. Flight filed this motion to stay and enforce the Release’s arbitration provision. The court, analyzing a question of first impression in Connecticut, found the waiver of the constitutional right by a non-parent on behalf of a minor was unenforceable. Connecticut, by statute recognizes, generally, the enforceability of arbitration agreements. General Statutes § 52-409,1 provides: “If any action for legal or equitable relief or other proceeding is brought by any party to a written agreement to arbitrate, the court in which the action or proceeding is pending, upon being satisfied that any issue involved in the action or proceeding is referable to arbitration under the agreement, shall, on motion of any party to the arbitration agreement, stay the action or proceeding until an arbitration has been had in compliance with the agreement, provided the person making application for the stay shall be ready and willing to proceed with the arbitration.”

But a threshold question is the enforceability of the agreement to arbitrate. Of course, as we know, a minor cannot enter into an enforceable contract (with certain exceptions for “necessities” and post-majority ratification). But the minor plaintiff did not sign the contract herself; instead there was the implied evidence that Mr. Rivera was authorized to sign the Release on her behalf. Flight asserted that the plaintiff was bound by the Release as Mr. Rivera's “ward,” under the theory of apparent authority. The minor plaintiff's voluntary presence at the defendant's place of business with Mr. Rivera appeared to grant Mr. Rivera sufficient authority to sign the agreement on behalf of the minor plaintiff. Further favoring the defendant's position is that no facts were presented to dispute the defendant's good faith belief that Mr. Rivera was acting with authority.

But, under Connecticut law, a parent can only settle a post-injury claim by a minor without Probate Court approval if the amount of the settlement is less than ten thousand dollars. This limited right to settle a claim on behalf of a child exists in Connecticut despite the court's continued emphasis on the fundamental right that parents maintain to make decisions concerning the care, custody, and control of their children. The law limiting parental rights in the constitutionally protected area of custodial decision-making highlights the weakness of the defendant's essential claim; that a noncustodial third-party ought to be authorized to make binding decisions involving the rights, and against the interests of, a minor child.

“As a matter of first impression, this court concludes that such a contract is voidable to the extent that it purports to waive a child's constitutional right of access to our courts.” This case is sure to be appealed and likely to attract broader industry attention.

Brian F. Mark

No interesting decisions this edition. Be sure to check back in two weeks.

Eric T. Boron

11/25/20 State Farm vs. Michael Mizuno

Supreme Court of Hawaii

Auto Insurance – Uninsured Motorist Coverage – “Chain of Events” Test

The Supreme Court of Hawaii accepted the following certified question from the United States Court of Appeals for the Ninth Circuit (“Ninth Circuit”):

Under Hawaii law, is a permissive user of an insured vehicle, whose connection to the insured vehicle is permission to use the vehicle to run errands and drive to work, entitled to uninsured motorist (UM) benefits under the chain-of-events test because he was injured by an uninsured motorist?